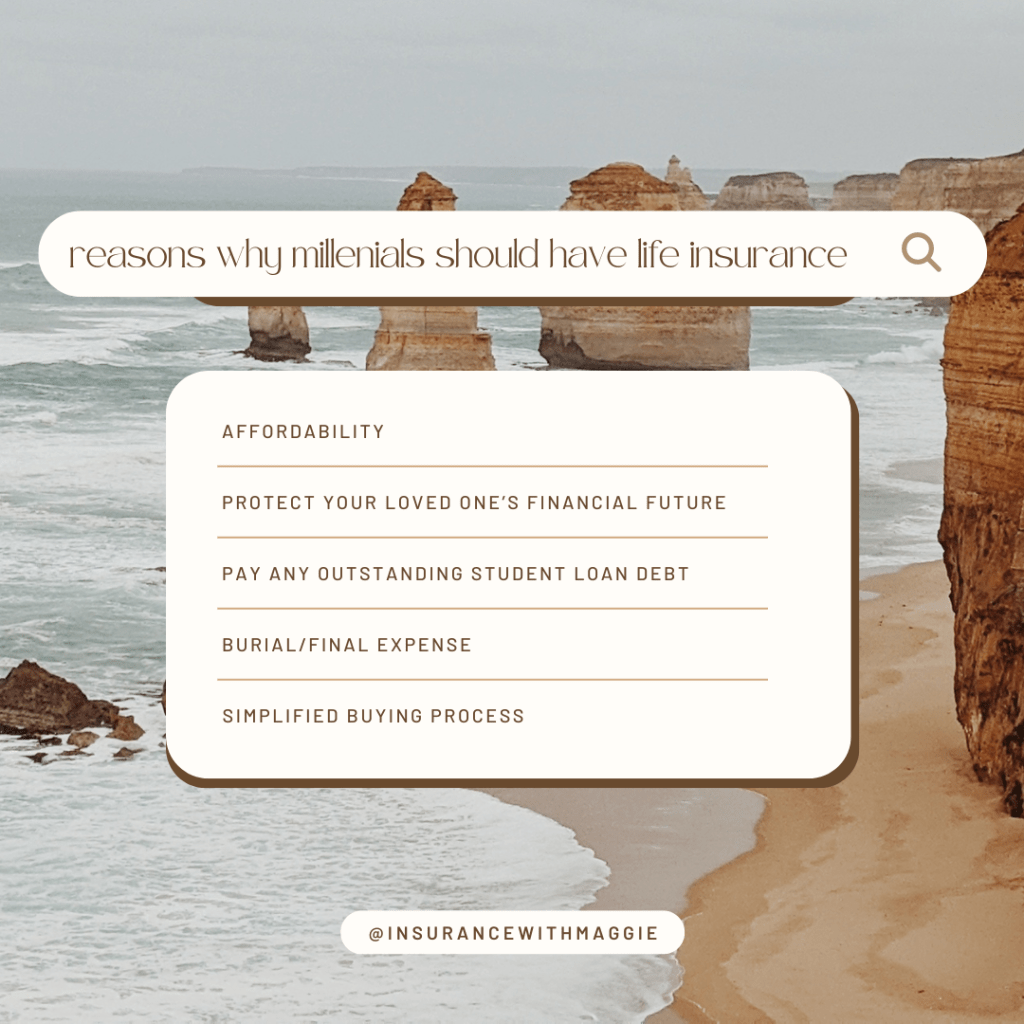

Many Millennials may not think about life insurance until later in life, but there are compelling reasons to start sooner rather than later.

One of the biggest benefits is affordability. Locking in a life insurance policy while you’re young and healthy can save you a lot of money. For example, a 20-year, $500,000 term policy for someone under 40 costs under $325 per year. Waiting until you’re older could more than double that cost, making it much more expensive.

Life insurance also protects your loved ones. Many Millennials have young children or partners who rely on their income. In the event something happens to you, life insurance provides a crucial safety net. It helps cover essential living expenses, ensuring your family isn’t left facing financial hardship during an already difficult time.

Another key benefit is that life insurance can help cover student loan debt. A significant number of Millennials carry student loans, and life insurance ensures that if you pass unexpectedly, your loved ones or co-signers won’t be left with the burden of paying off your loans.

Funeral expenses are another consideration. Funerals can cost upwards of $8,000, which can be a heavy financial burden for grieving family members. Life insurance can ease this concern by covering funeral costs and other final expenses, allowing your family to focus on healing rather than finances.

Lastly, getting life insurance is easier than ever. Many insurers now offer simplified underwriting, allowing Millennials to get coverage without needing a medical exam. This makes the process quicker and more convenient, ensuring you can get protected with minimal hassle.

Life insurance offers more than just peace of mind—it’s a way to safeguard your family’s financial future. By starting now, you can lock in lower rates and ensure your loved ones are taken care of, no matter what.

If you’re curious about how it could fit into your plans or just want to explore your options, feel free to reach out. I’m here to help guide you through the process and answer any questions you might have.

Source: Insurance Barometer Study (2021 and 2022), LIMRA and Life Happens; Automated and Accelerated Underwriting: Life Insurance Company Practices in 2021, LIMRA, 2022.

#LifeInsurance #Millennials #FinancialProtection #SecureYourFuture #PlanAhead

Leave a comment